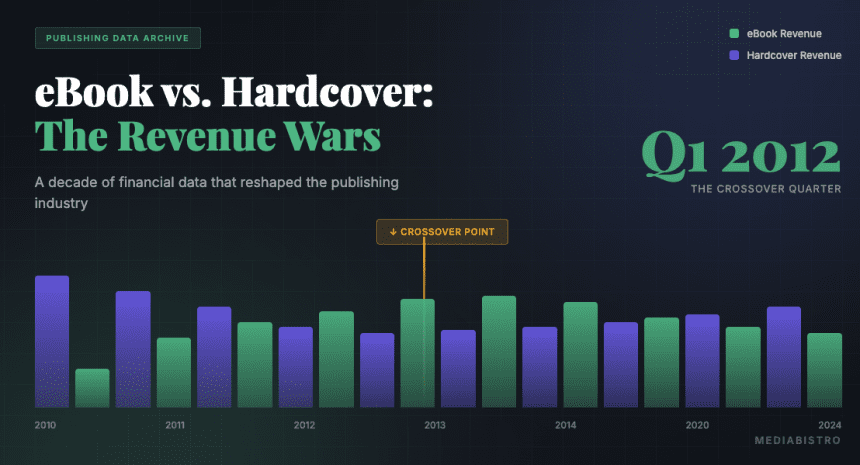

The first quarter of 2012 marked a watershed moment in publishing history. For the first time, net sales revenue from eBooks surpassed hardcover books in the United States—a shift that industry analysts had been predicting, dreading, or championing for half a decade.

According to the Association of American Publishers (AAP) March 2012 net sales revenue report, adult eBook sales reached $282.3 million while adult hardcover sales totaled $229.6 million. The digital insurgency had officially breached the castle walls.

Also on Mediabistro

But the story of how publishing arrived at that inflection point—and where it went afterward—reveals a more nuanced narrative than the “death of print” headlines suggested. This resource chronicles the financial data, market dynamics, and industry pivots that defined the Format Wars era and shaped the publishing landscape that professionals navigate today.

The Digital Disruption (2010–2014): When the Numbers Started Moving

2010: The Year Everything Changed

Amazon’s Kindle had been on the market since 2007, but 2010 was the year the publishing industry’s economic foundations began to visibly crack.

In July 2010, Amazon reported that Kindle book sales had surpassed the company’s total hardcover sales. The announcement sent tremors through boardrooms from midtown Manhattan to Frankfurt. By year’s end, eBook revenues tracked by the AAP had reached $446.3 million—still a fraction of the print market, but growing at triple-digit rates.

The same year brought Apple’s iPad and, with it, the agency pricing model that would reshape the economics of digital publishing. Under the agency model, publishers—not retailers—set consumer prices, keeping 70% of proceeds while retailers took a 30% commission. This was a direct challenge to Amazon’s wholesale model and its aggressive $9.99 price point for bestsellers.

Five major publishers—Hachette, HarperCollins, Macmillan, Penguin, and Simon & Schuster—adopted agency pricing for eBooks sold through Apple’s iBookstore. The move was designed to solve what industry insiders called “the $9.99 problem”: Amazon’s deep discounting was capturing market share while conditioning consumers to expect digital books at prices that, publishers argued, devalued the written word.

The strategy worked in the short term. Other retailers saw their margins protected, and Amazon’s stranglehold on eBook market share loosened slightly. But the legal consequences would prove severe.

2011: The 117% Surge

The numbers from 2011 were staggering. Despite some slowdown in the fourth quarter, eBook sales rose 117% for the full year, generating revenue of $969.9 million at companies reporting to the AAP—more than double the $446.3 million recorded in 2010.

The print market moved in the opposite direction. Adult trade hardcover revenue fell 17.5% to $1.29 billion. Adult trade paperback dropped 15.6% to $1.17 billion. The mass-market paperback category—those drugstore rack novels—lost 36% of its value.

Within adult fiction specifically, eBooks became the largest single format, surpassing hardcover, trade paperback, and mass market paperback. Digital sales in the category hit $1.27 billion, representing 30% of segment revenue.

Amazon announced in April 2011 that customers were choosing Kindle books more often than print: for every 100 print books sold, 105 Kindle eBooks moved. The psychological barrier had fallen.

Yet for all the disruption, Q1 2011 still showed hardcover ahead of eBooks in aggregate revenue: $335 million versus $220.4 million. The crossover hadn’t happened yet.

2012: The Pivot Point

The first quarter of 2012 delivered the data point that launched a thousand think pieces. The AAP’s March report, collecting data from 1,189 publishers, confirmed what many had anticipated: adult eBook net sales ($282.3 million) exceeded adult hardcover net sales ($229.6 million).

The swing represented a $167.3 million shift in relative position within a single year.

For the professionals tracking these numbers—acquisition editors, sales directors, literary agents, and authors negotiating contract terms—the implications were immediate. Royalty calculations shifted. Advance models required revision. Backlist strategy transformed as older titles with minimal print inventory became valuable digital assets. Rights negotiations intensified as the value of digital rights in territorial deals increased substantially.

The same year brought legal reckoning for the agency model. The Department of Justice filed an antitrust lawsuit against Apple and the five publishers who had adopted agency pricing, charging them with conspiracy to raise eBook prices. Three publishers settled immediately. The remaining two followed. Apple fought the charges, lost, and ultimately agreed to a $450 million settlement.

2013–2014: The Plateau Emerges

By 2013, the growth rate for eBooks had begun to moderate. Digital still captured 21% of trade sales—rising to 23.3% by year’s end—but the exponential curves of 2010–2011 had flattened.

Several factors contributed to the stabilization. Device saturation meant the early adopters who drove Kindle and Nook sales had already converted. Price normalization following the agency settlement narrowed the cost advantage over print. Genre differentiation emerged as romance, mystery, and science fiction readers embraced digital formats at higher rates than literary fiction audiences. And the resurgence of independent bookstores—written off as casualties of the Amazon era—began a slow revival that reinforced the value of physical books.

The Q1 Revenue Milestones: A Close Analysis

The Q1 periods of 2011 and 2012 represent the hinge point of the Format Wars. Understanding the specific dynamics of these quarters illuminates why this data became the most-cited reference in the publishing industry.

Q1 2011: The Last Quarter of Print Dominance

In the first quarter of 2011, the old order still held. Adult hardcover generated $335 million while adult eBooks brought in $220.4 million—a gap of $114.6 million in hardcover’s favor.

This data point represented the publishing industry’s last stand. Hardcover—the flagship format, the revenue driver for frontlist titles, the format that commanded premium shelf space and gift-giving prestige—still outperformed its digital challenger.

But the trend lines told a different story. Q1 2011’s hardcover figure was already down significantly from prior years. And the eBook number, while lower in absolute terms, reflected growth rates that print could not match. Industry executives monitoring the AAP reports understood the crossover was imminent. The only questions were when and how publishers would respond.

Q1 2012: The Crossover Quarter

Twelve months later, the positions had reversed. Adult eBooks hit $282.3 million (up 28% year-over-year) while adult hardcover fell to $229.6 million (down 31% year-over-year). The gap: $52.7 million in eBooks’ favor.

The Q1 2012 data didn’t just record a milestone—it forced operational changes across the industry within months of its release.

Historical Quarterly Revenue Milestones

The following table summarizes the key financial shifts in U.S. publishing during the Format Wars era. All figures represent net sales revenue reported to the Association of American Publishers.

| Period | Adult Hardcover Revenue | Adult eBook Revenue | eBook Growth (YoY) | Market Event |

|---|---|---|---|---|

| Q1 2010 | $394 million | $91 million | +252% | iPad launches; agency pricing introduced |

| Full Year 2010 | $1.57 billion | $446.3 million | +164% | Amazon reports Kindle outselling hardcover |

| Q1 2011 | $335 million | $220.4 million | +142% | Amazon: eBooks outsell all print combined |

| Full Year 2011 | $1.29 billion | $969.9 million | +117% | DOJ investigation of agency pricing begins |

| Q1 2012 | $229.6 million | $282.3 million | +28% | eBooks surpass hardcover for first time |

| Full Year 2012 | $1.12 billion | $1.54 billion | +59% | Agency pricing lawsuit settlements |

| Q1 2013 | $247 million | $298 million | +6% | Growth rate moderation begins |

| Full Year 2013 | $1.15 billion | $1.61 billion | +5% | eBooks reach 23.3% of trade sales |

| Full Year 2014 | $1.19 billion | $1.49 billion | -7% | First annual eBook revenue decline |

Source: Association of American Publishers StatShot reports

The Current State of the Market: Stability After the Storm

The publishing industry of 2025 bears little resemblance to the chaotic transition years of 2010–2014. The Format Wars have ended—not with a decisive victory for either side, but with an entrenched equilibrium.

The Numbers Today

According to the AAP’s StatShot Annual Report, U.S. publishing revenues totaled $32.5 billion in calendar year 2024, an increase of 4.1% from $31.3 billion in 2023. Between 2020 and 2024, total industry sales increased 22.1%.

The format breakdown reveals print’s enduring dominance. Print formats (hardback, paperback, mass market, special bindings) account for 50.5% of publisher revenue. Digital formats (eBooks and digital audio) account for 14% of all revenue, with eBooks generating $2.1 billion—approximately 10% of trade revenue.

For trade publishers focusing on consumer books, print’s share is even more pronounced: physical formats account for over 75% of trade revenue.

The most significant shift since the Format Wars hasn’t been eBook growth but audiobook expansion. Digital audio revenue grew 78.1% between 2020 and 2024. By 2024, audiobooks (11.3% of trade formats) had surpassed eBooks (10%) in market share—a development few analysts predicted during the Kindle fever of 2011.

Why Print Survived

The persistence of print books defied the predictions of many technology observers, who expected digital formats to dominate publishing, as they had in music. Several factors explain the difference.

Unlike music, which consumers experience identically across formats, the reading experience differs meaningfully between print and digital. Page feel, marginalia, spatial memory of text location, and the absence of notification interruptions create value that digital cannot replicate for many readers.

Print books also serve social and decorative functions beyond their content. Bookshelves communicate identity. Gift-giving favors physical items. The Instagram-era valorization of “shelfies” reinforced print’s cultural status.

As digital interfaces colonized work and communication, many readers sought print as refuge from screens—a dynamic accelerated by the pandemic’s forced migration to remote work. Meanwhile, independent bookstores, which grew from approximately 1,400 American Booksellers Association members in 2009 to over 2,400 by 2024, serve as community hubs that reinforce the value of physical books.

The New Equilibrium

For media professionals navigating today’s publishing landscape, the key insight from the Format Wars is that format preferences are not zero-sum. The industry evolved from “eBooks will kill print” panic to a stable multi-format ecosystem where print dominates literary fiction and illustrated books, eBooks maintain strong positions in genre fiction (particularly romance and mystery), and audiobooks represent the primary growth vector for nonfiction and commuter-friendly content.

Format choice often varies by title rather than by reader—the same consumer might buy a cookbook in hardcover, read a thriller as an eBook, and listen to a memoir as an audiobook.

The revenue data from Q1 2012 remains historically significant because it marks the moment digital and physical formats reached parity. But the subsequent decade proved that parity was the destination, not a waypoint on the road to digital dominance.

Topics:

Business Basics